Get a VIRTUAL Credit Card today

Virtual Credit Cards in Finland

Compare the rewards

See what credit card fits you

Apply today and get an instant answer

*Example: €1,500 credit, variable nominal interest rate 19.50% (reference interest rate according to the Interest Act 4.50% + 15.00% margin), effective annual interest rate 21.34%. Repayment in 12-month installments €138.59/month, share of expenses €163.12, total cost €1,663.12.

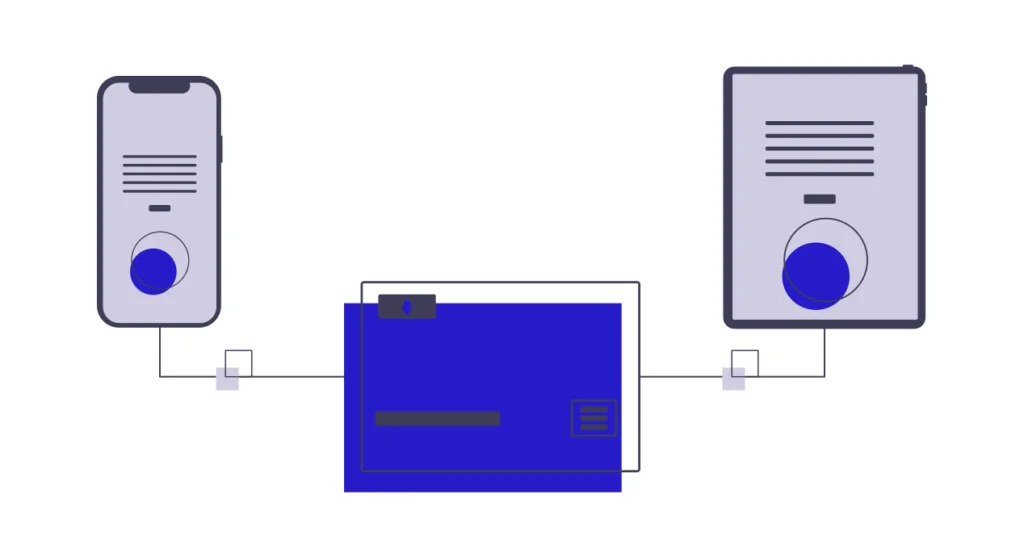

Applying for a virtual credit card in Finland has two main avenues: using your existing bank or credit card account or opting for a digital-first provider that allows you to create a new account online.

The first option allows current account holders to easily add a virtual card feature, facilitating secure online transactions. Alternatively, digital-first financial services offer a streamlined, entirely online application process, enabling quick setup and access to a virtual credit card without an existing account.

In this guide, we’ll explore how virtual credit cards work, their benefits, and how they can be a smart choice for anyone making purchases online in Finland.

Best Virtual Credit Cards in 2025

*Example: €1,500 credit, variable nominal interest rate 19.50% (reference interest rate according to the Interest Act 4.50% + 15.00% margin), effective annual interest rate 21.34%. Repayment in 12-month installments €138.59/month, share of expenses €163.12, total cost €1,663.12.

The Sweep Virtual Credit Card offers a digital-first financial solution in Finland, integrating a credit card with a banking app for a comprehensive experience. Here are its standout features:

- Interest-Free Payment Period: Get up to 60 days interest-free on your purchases, allowing for better financial management.

- Earnings: The linked current account offers 1% annual interest, with potential savings interest up to 4.00% annually.

- Cashback: Earn up to 5% back on purchases made through the Deals program.

- No Fees: There are no monthly or annual fees associated with the card.

- Quick Activation: The virtual card can be activated swiftly, enabling immediate use.

- Environmental Benefit: Opting for a virtual card reduces plastic waste.

- Global Use: Use the card worldwide wherever Mastercard® is accepted, both in-store with NFC or Apple Pay and online.

- Security: Enjoy Mastercard’s Zero Liability coverage for unauthorized transactions.

The Sweep Virtual Credit Card merges convenience with functionality, offering a modern credit solution for users in Finland.

What is a Virtual / Digital Credit Card?

A virtual or digital credit card is a digital version of a traditional credit card that exists solely in electronic form. It’s designed to be used for online purchases or over the phone, not in physical stores. Here’s a breakdown of what a virtual credit card entails:

- Unique Card Number: Each virtual card is associated with a unique card number, distinct from your physical card’s number, which can be used for online transactions.

- Expiration Date and Security Code: Like a physical card, a virtual credit card has an expiration date and a security code (CVV), which are used during the transaction process.

- Temporary or Single-Use: Many virtual credit cards are temporary, with the option to set a specific expiration date or limit their use to a single transaction, enhancing security.

- Linked to Your Main Account: Despite having different numbers, transactions made with a virtual credit card are charged to your main account, just like those made with your physical card.

- Customizable Spending Limits: Users often have the option to set spending limits on a virtual credit card, providing more control over their finances.

- Easy Cancellation: If a virtual card number is compromised, it can be canceled immediately without affecting your primary credit card account or requiring a new physical card.

How to apply for a virtual credit card online with SweepBank

SweepBank streamlines the process of obtaining a virtual credit card, making it quick and user-friendly.

Here’s how you can apply for a virtual credit card with SweepBank:

1. Eligibility

Before applying, ensure you meet SweepBank’s requirements: at least 20 years old, continuous employment for at least four months, a regular income of €1,600 or more per month, and a good credit standing.

2. Application Process

Step 1: Initiate your credit card application at any time through the SweepBank platform.

Step 2: The approval process is swift, with decisions made within minutes.

Step 3: Once approved, your virtual credit card will be instantly available in the SweepBank app.

3. Activation and Use

After approval, you can activate your virtual credit card directly in the app. This process is quick, enabling you to start using your card for online purchases and phone transactions immediately.

By following these steps, you can enjoy the convenience and security of a SweepBank virtual credit card, with the entire process from application to activation taking just minutes.

How to get a Virtual Credit Card for your existing bank account

Applying for a virtual credit card in Finland is typically a straightforward process, often integrated into your existing online banking or credit card account. Here’s how you can apply for one:

- Check with Your Bank: First, verify if your bank or credit card issuer offers virtual credit cards. Most major institutions provide this feature as part of their online services.

- Access Your Online Account: Log in to your online banking or credit card account. Look for the section dedicated to virtual credit cards, which might be under “Card Services” or a similar category.

- Request a Virtual Card: Follow the prompts to request a virtual credit card. You may need to specify the account to link it with if you have multiple accounts or cards.

- Set Limits (If Applicable): Depending on the issuer’s features, you might have the option to set a spending limit or expiration date for the virtual card.

- Activate the Card: Once your request is processed, you’ll receive the virtual card details, including the card number, expiration date, and CVV. Some banks might require you to activate the card before use.

- Start Using: With the virtual card activated, you can start using it for online purchases or phone transactions, just as you would with a physical card, but with an added layer of security.

FAQ

Frequently Asked Questions

A virtual credit card provides a unique, digital card number that’s linked to your main credit card account but doesn’t reveal your actual credit card details. It’s used primarily for online and over-the-phone transactions to enhance security.

You can apply for a virtual credit card through your existing bank or a digital service provider. The process typically involves logging into your online banking platform or the service provider’s app, where you can request and instantly receive your virtual card details.

Yes, virtual credit cards are designed to offer enhanced security. By using a unique, temporary card number for transactions, they minimize the risk of your actual card details being compromised.

Virtual credit cards are primarily intended for online or over-the-phone purchases. However, if linked with mobile payment systems like Apple Pay or Google Pay, they can be used for in-store NFC (Near Field Communication) transactions.

Fees can vary depending on the issuer. Some virtual credit cards come with no additional fees, while others might have specific charges. Always check the terms and conditions provided by the card issuer.

Virtual credit cards can often be generated instantly once you apply, providing immediate access to the card details through the issuer’s online platform or app.

Yes, some issuers allow you to generate multiple virtual cards, which can be useful for managing different subscriptions or expenses separately.